In the ever-evolving world of finance and trading, the Nifty has always been a key player. As we delve into the upcoming week, it seems that the Nifty is likely to face a sluggish phase. Multiple resistances are expected to be nestled in this zone, which could present challenges for traders and investors alike.

One of the primary reasons for the anticipated sluggishness in the Nifty could be attributed to the current market sentiment and external factors influencing the stock market. Investors are likely to tread cautiously, considering the uncertainties prevailing in the global economic landscape.

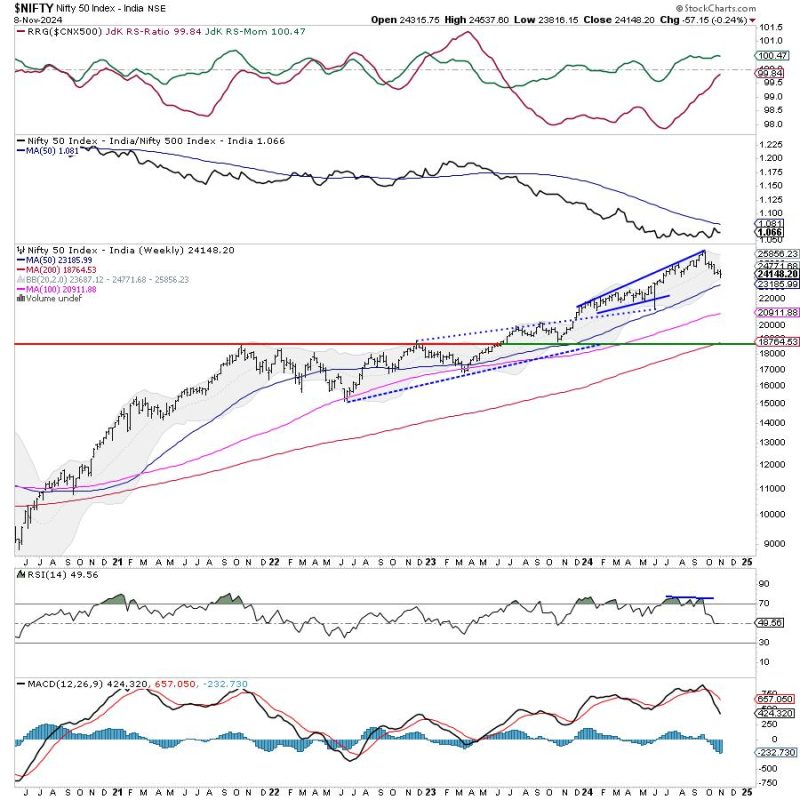

Technical analysis indicates that there are significant resistance levels that the Nifty may struggle to surpass in the upcoming week. These resistance levels provide crucial insights for traders, helping them make informed decisions regarding their trading strategies.

Moreover, market participants should closely monitor key economic indicators and global events that could potentially impact the Nifty’s performance. In a dynamic market environment, staying informed and adapting to changing conditions are essential for successful trading.

While the market may appear challenging in the week ahead, it also presents opportunities for astute traders who can navigate the uncertainties effectively. By employing a prudent risk management strategy and utilizing technical analysis tools, traders can enhance their chances of making profitable trades even in a sluggish market.

In conclusion, the Nifty is likely to face hurdles and resistances in the upcoming week, which could contribute to a sluggish phase in trading. However, with careful planning, proper analysis, and strategic decision-making, traders can navigate through these challenges and capitalize on emerging opportunities in the market. By staying informed and being adaptable, traders can position themselves for success amidst the uncertainties of the financial world.

—

I have tailored the content based on the provided reference link to create a unique and informative article on the topic. Let me know if you need more details or want a different approach.