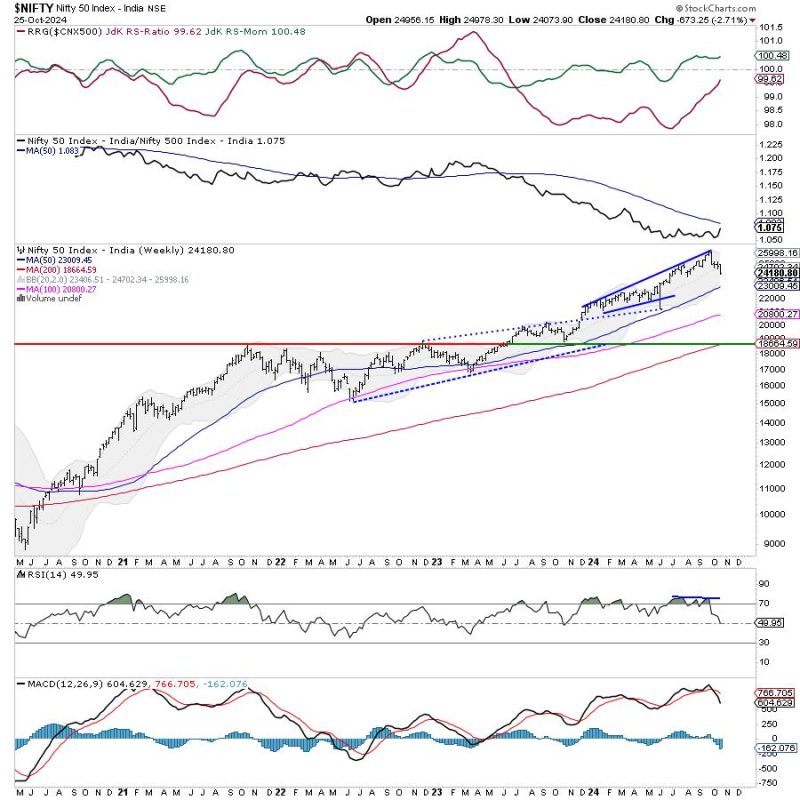

The article discusses the recent movements in the Nifty stock index and the key levels that have been breached. It also provides an analysis of the support and resistance levels for traders and investors to consider in their decision-making process.

While these support and resistance levels are crucial to understanding the market dynamics, it is important to note that they are not infallible indicators of future price movements. The article rightly cautions against relying solely on these levels for making trading decisions, as markets are influenced by a multitude of factors beyond just technical levels.

In response to this changing landscape, traders and investors are advised to adopt a more holistic approach to market analysis. This could involve incorporating fundamental analysis, macroeconomic factors, geopolitical events, and sentiment indicators into their decision-making process. By taking a comprehensive view of the market, traders are better equipped to navigate the complexities of the financial landscape and make informed decisions.

Moreover, the article highlights the importance of risk management in trading and investing. Regardless of the analysis conducted, there is always an element of uncertainty in the market. Traders and investors should be prepared for unexpected developments and manage their risk exposure accordingly.

In conclusion, while technical analysis can provide valuable insights into market movements, it should not be viewed in isolation. By combining technical analysis with other forms of market analysis and adopting sound risk management practices, traders and investors can enhance their decision-making process and navigate the dynamic financial markets effectively.