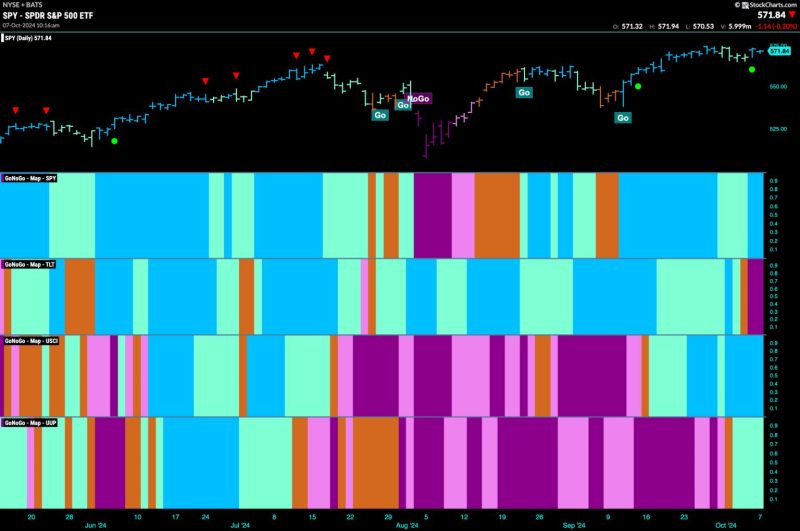

Equities Remain in Go Trend and Lean into Energy

The global equities market continues to ride the Go trend, showing clear signs of strength and resilience in the face of evolving market conditions. Investors are increasingly leaning into energy-related sectors, betting on the potential for significant growth and value creation in this space.

The energy sector has long been a cornerstone of the global economy, providing essential resources to power industries, infrastructure, and everyday life. In recent years, advancements in technology and increasing global demand have reshaped the energy landscape, creating new opportunities for investors to capitalize on emerging trends and developments.

One key driver of the current interest in energy equities is the ongoing transition towards cleaner and more sustainable sources of energy. As governments around the world enact policies to reduce carbon emissions and combat climate change, companies that are at the forefront of renewable energy, energy efficiency, and other sustainable solutions are poised to benefit from this shift.

Furthermore, the recovery of the global economy following the COVID-19 pandemic has led to a resurgence in energy demand, particularly in sectors such as transportation, manufacturing, and construction. This increased demand, coupled with supply constraints and geopolitical factors, has contributed to rising commodity prices and boosted the profitability of energy companies.

Investors looking to capitalize on the energy trend have a variety of options to consider, ranging from traditional oil and gas companies to renewable energy providers and technology firms focused on energy innovation. Diversification within the energy sector can help mitigate risk and provide exposure to different segments of the market.

While the energy sector offers attractive opportunities for growth and value creation, investors should also be mindful of the risks and uncertainties that come with investing in this space. Volatility in commodity prices, regulatory changes, and geopolitical tensions can all impact the performance of energy equities, underscoring the importance of thorough research and strategic portfolio management.

In conclusion, the current Go trend in equities is driving increased interest in the energy sector, presenting investors with a range of opportunities to capitalize on emerging trends and developments. By leaning into energy-related investments and staying informed about market dynamics, investors can position themselves to benefit from the ongoing evolution of the global energy landscape.