In the fast-paced and ever-changing world of finance, staying ahead of market moves is crucial for investors and traders alike. The Nifty index is one of the key instruments in the Indian stock market, representing the performance of the top 50 companies in various sectors. Analyzing the Nifty from a broader perspective provides valuable insights into market trends and potential opportunities.

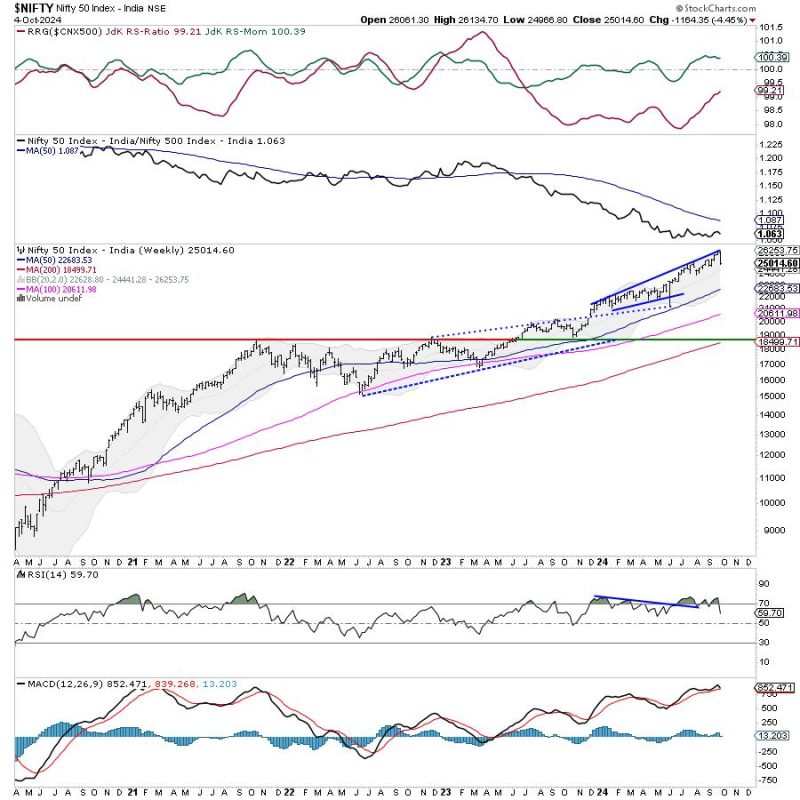

Technical analysis is a powerful tool used by market analysts to forecast future price movements based on historical data. By examining charts and key indicators, traders can identify patterns and trends that may indicate potential buying or selling opportunities. In the case of the Nifty index, technical analysis can help traders gain a deeper understanding of market dynamics and make more informed decisions.

Market sentiment plays a significant role in influencing market moves. By gauging investor sentiment through tools such as the Fear and Greed Index or options data, traders can assess the prevailing mood in the market and adjust their strategies accordingly. Understanding the emotional factors driving market participants can provide key insights into potential market movements.

Global macroeconomic factors also have a significant impact on the performance of the Nifty index. Events such as interest rate decisions, geopolitical tensions, or economic data releases can trigger volatility in the market and influence investor behavior. Keeping a close eye on global developments and their potential implications for the Indian market can help traders anticipate and navigate market moves more effectively.

Risk management is a crucial aspect of successful trading. By setting clear risk management rules and using tools such as stop-loss orders, traders can protect themselves from excessive losses and preserve their capital. Understanding the risks associated with trading the Nifty index and implementing sound risk management practices are essential for long-term success in the market.

In conclusion, analyzing market moves in perspective and keeping a close eye on the Nifty index from various angles can provide valuable insights for traders and investors. By incorporating technical analysis, gauging market sentiment, monitoring global macroeconomic factors, and practicing effective risk management, market participants can navigate the volatility of the market more effectively and make informed trading decisions.