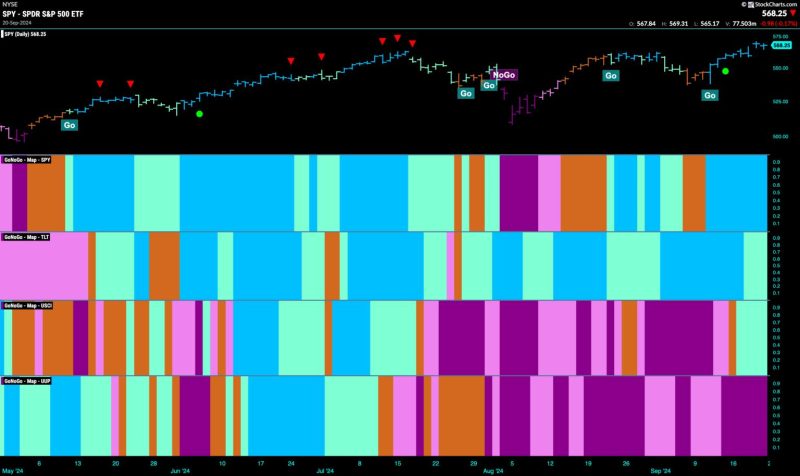

Equities Remain in Strong Go Trend Powered by Financials

Article

In the realm of financial markets, equities have been displaying a resilient and steadfast upward momentum, with the trend remaining largely positive in recent times. Key drivers behind this market movement include the substantial influence of the financial sector, as financial companies continue to play a crucial role in shaping market dynamics and investor sentiment. As we delve deeper into the reasons for this prevalence of a strong Go trend in equities, it becomes evident that the financial sector is acting as a primary catalyst in propelling stock prices higher.

One of the significant contributing factors to the enduring strength of equities is the buoyancy exhibited by financial institutions. Banks, investment firms, and other entities within the financial sector have been posting robust earnings and demonstrating strong levels of resilience, despite the challenges posed by the economic environment. This resilience has instilled confidence among investors, leading to increased capital inflows into equities and lending support to the overall market trend.

Moreover, the prevailing low-interest-rate environment has also played a pivotal role in buoying equities, with financial companies benefitting from lower borrowing costs and enhanced profitability. The Federal Reserve’s accommodative monetary policy stance, characterized by near-zero interest rates, has provided a conducive backdrop for financial institutions to thrive and expand their operations. This favorable interest rate environment has underpinned the growth prospects of the financial sector and, by extension, supported the broader equity market uptrend.

Additionally, the ongoing wave of technological innovation within the financial sector has further bolstered the sector’s performance and reinforced its position as a key driver of market momentum. Fintech advancements, digitalization of financial services, and the emergence of new disruptive business models have transformed the industry landscape, enhancing efficiency, reducing costs, and improving customer experiences. These technological developments have not only propelled the growth of financial companies but have also attracted investor interest and propelled equities higher.

Furthermore, the regulatory environment governing financial institutions has undergone significant changes in recent years, aimed at enhancing transparency, stability, and investor protection within the sector. Stricter regulatory standards and robust risk management practices have instilled greater confidence in the financial system, assuaging concerns about systemic risks and bolstering investor trust. This regulatory framework has contributed to a healthier financial sector, strengthening its foundations and supporting its role as a pillar of market stability.

As we navigate through the intricacies of the financial markets, it becomes apparent that the relentless momentum of equities is underpinned by the steadfast performance of the financial sector. The enduring strength of financial companies, supported by favorable macroeconomic conditions, technological advancements, and robust regulatory oversight, has propelled equities higher and sustained the prevailing positive trend. As investors continue to monitor market developments and navigate evolving dynamics, the pivotal role of the financial sector in driving equities remains a key consideration in shaping investment perspectives and market outcomes.