Certainly! Here is the article:

Before diving into the debate of bullish vs bearish sentiments surrounding rate cuts and stock performance, it’s imperative to understand the significant impact that changes in interest rates can have on the wider economy and financial markets. Historically, central banks have used two primary tools to control monetary policy: adjusting interest rates and implementing quantitative easing measures.

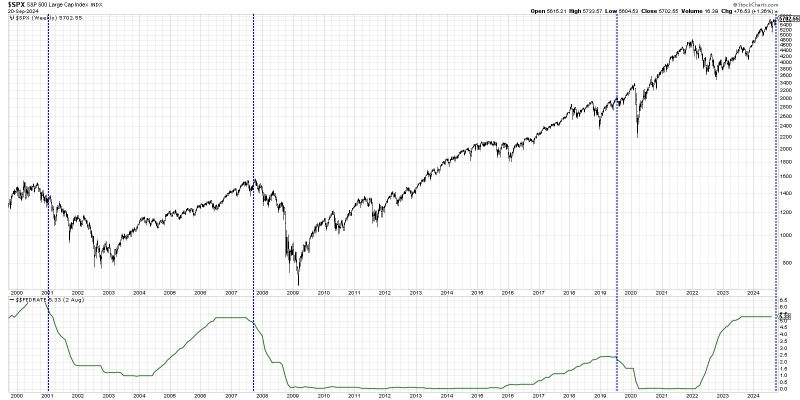

Rate cuts are often seen as a tool to stimulate economic growth by making borrowing cheaper, encouraging businesses and consumers to spend and invest more. This, in turn, can lead to increased corporate profits and higher stock prices as optimism about future growth prospects rises. Consequently, when central banks announce rate cuts, it is not uncommon for stock markets to react positively, particularly in sectors that benefit from lower borrowing costs such as real estate and construction.

Conversely, the argument against rate cuts is rooted in the idea that they could signal underlying economic weakness or concerns about the future. Some investors believe that continuously lowering interest rates may lead to asset bubbles, distortions in asset pricing, and eventually unsustainable market conditions. Moreover, in the long term, low interest rates could impact savers and retirees who rely on fixed-income investments for their income.

One key aspect to consider when discussing the correlation between rate cuts and stock performance is the timing of such policy decisions. Market participants often analyze the rationale behind rate cuts and the broader economic context in which they occur to gauge the potential impact on different sectors and industries. For example, during periods of economic uncertainty, rate cuts can provide a much-needed boost to confidence and liquidity in financial markets, supporting equities.

It’s essential for investors to closely monitor not just the rate cuts themselves but also the accompanying statements from central banks regarding their future outlook and policy direction. The tone and guidance provided by policymakers can influence market sentiment and expectations, shaping how investors position themselves in response to interest rate changes.

In conclusion, the relationship between rate cuts and stock performance is multifaceted and subject to various factors and interpretations. While rate cuts can initially trigger bullish sentiments in the stock market, the long-term implications and consequences of such monetary policy decisions require careful consideration. By staying informed, conducting thorough analysis, and diversifying their portfolios, investors can navigate the complexities of rate cuts and make informed decisions to protect and grow their investments over time.