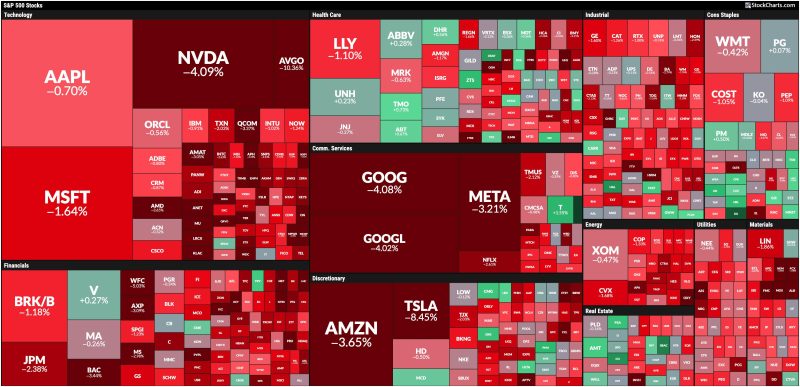

Broad-Based Stock Market Selloff: How to Position Your Portfolio

Diversification is Key:

Ensuring that your portfolio is diversified across different asset classes and industries can help mitigate the impact of a broad-based stock market selloff. By spreading your investments across various types of assets such as stocks, bonds, and real estate, you can reduce the risk associated with a downturn in any one particular sector.

Focus on Quality:

In times of market turmoil, it is important to focus on the quality of the companies in which you are investing. Look for companies with strong fundamentals, stable cash flows, and a history of consistent performance. Investing in quality companies can help your portfolio weather the storm during a broad-based selloff.

Consider Defensive Stocks:

Defensive stocks are those that tend to perform well even in tough economic conditions. These companies typically offer products or services that are in constant demand, regardless of the economic environment. Examples of defensive sectors include healthcare, consumer staples, and utilities. Adding defensive stocks to your portfolio can help provide stability during a market selloff.

Maintain a Long-Term Perspective:

During a broad-based selloff, it can be tempting to panic and sell off your investments in fear of further losses. However, it is important to maintain a long-term perspective and avoid making knee-jerk reactions. Historically, stock markets have always recovered from downturns, and staying invested for the long term can help you benefit from the eventual recovery.

Review and Rebalance Your Portfolio:

Regularly reviewing and rebalancing your portfolio is essential, especially during periods of market turbulence. Reassess your investment goals, risk tolerance, and asset allocation to ensure that your portfolio remains aligned with your objectives. Rebalancing may involve selling off overperforming assets and buying more of those that have underperformed to maintain the desired asset allocation.

Stay Informed:

In uncertain market conditions, staying informed about economic trends, global events, and market developments is crucial for making informed investment decisions. Keep yourself updated by reading financial news, attending webinars, and consulting with financial advisors to gain insights and perspectives that can help you navigate through a broad-based stock market selloff.

In conclusion, a broad-based stock market selloff can be a challenging time for investors, but with the right strategies and a disciplined approach, you can position your portfolio to weather the storm and emerge stronger. Diversification, focusing on quality, considering defensive stocks, maintaining a long-term perspective, reviewing and rebalancing your portfolio, and staying informed are key factors that can help you navigate through turbulent market conditions and protect your investments. By following these guidelines, you can position yourself for long-term financial success despite short-term market fluctuations.