In a bizarre turn of events that defies belief, a cryptocurrency pig butchering scam has managed to wreck a Kansas bank and send its ex-CEO to prison for 24 years. The highly unusual and convoluted scheme involved a complex web of deceit and manipulation that ultimately led to severe consequences for those involved.

The story begins with the former CEO of the bank, Steven Reynolds, who was once a respected figure in the financial world. Reynolds, who was well-regarded for his astute business acumen and leadership skills, fell victim to the allure of cryptocurrencies and the promises of quick wealth they offered. Little did he know that his foray into this uncharted territory would lead to his downfall.

The scam took shape when Reynolds, in a bid to increase the bank’s profits, sought out investments in the burgeoning cryptocurrency market. Unbeknownst to the board of directors and shareholders, Reynolds funneled a significant portion of the bank’s funds into a sketchy cryptocurrency project known as PorkCoin. Promising high returns and guaranteed profits, PorkCoin claimed to revolutionize the agricultural industry by digitizing pig butchering processes.

As investors poured money into the project, enticed by the prospect of lucrative returns, suspicions began to arise. It soon became apparent that PorkCoin was nothing more than a sophisticated Ponzi scheme, with Reynolds at the helm. The funds were not used for any legitimate business purposes but instead siphoned off to fund Reynolds’ lavish lifestyle and prop up the failing bank’s balance sheet.

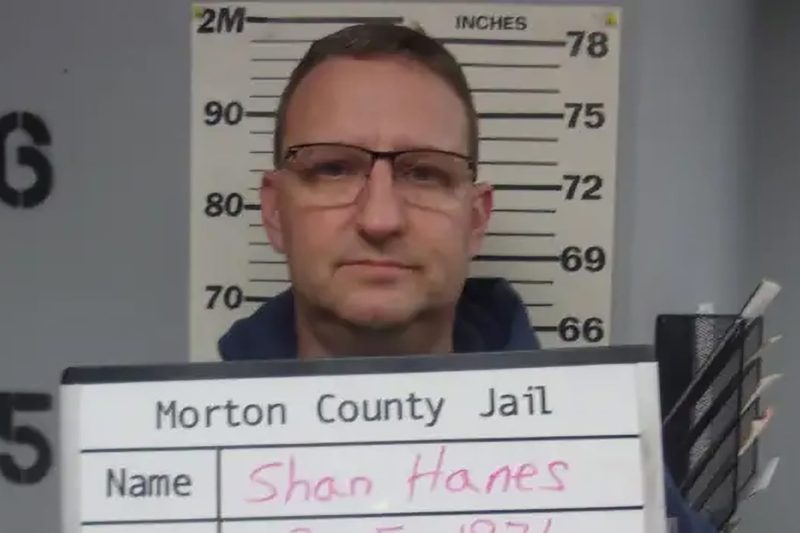

When the truth came to light, the repercussions were swift and severe. The Kansas bank, once a pillar of the community, crumbled under the weight of the scandal, leaving depositors and investors in financial ruin. Reynolds, who had once been hailed as a financial visionary, now faced the harsh reality of his crimes. He was swiftly convicted of fraud, embezzlement, and money laundering, resulting in a staggering 24-year prison sentence.

The fallout from the cryptocurrency pig butchering scam serves as a cautionary tale for those tempted by the allure of quick riches in the volatile world of cryptocurrencies. It highlights the importance of due diligence, transparency, and ethical practices in the financial industry. The case of Steven Reynolds and the Kansas bank stands as a stark reminder of the consequences of greed and deception in the pursuit of wealth. As investors and consumers navigate the complex landscape of cryptocurrencies and emerging technologies, it is imperative to remain vigilant and skeptical of promises that sound too good to be true.