**Analyzing the Strength Off the Lows, and Addressing Concerns That Remain**

**Overall Market Performance**

The recent uptrend in the market has shown resiliency in bouncing back from the lows experienced earlier in the year. Investors have regained confidence as key indicators suggest a positive sentiment in the market. However, while the recovery is notable, there are lingering concerns that need to be addressed to sustain this positive momentum.

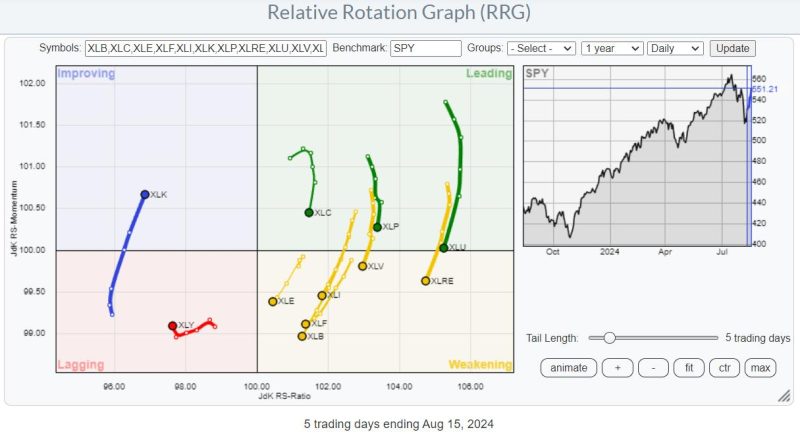

**Strength in Key Sectors**

Several key sectors have shown remarkable strength coming off the market lows. Technology stocks, in particular, have performed well, buoyed by solid earnings growth and increased demand for digital products and services. The healthcare sector has also demonstrated resilience, driven by ongoing innovation and the search for effective healthcare solutions.

**Market Sentiment and Investor Confidence**

Recent market data indicates a growing sense of optimism among investors. The robust performance of certain stocks and sectors has instilled confidence in the market’s ability to weather economic uncertainties. This positive sentiment is further supported by strong corporate earnings and promising economic indicators.

**Sector Concerns**

Despite the market’s overall strength, there are still concerns that could potentially impact future performance. Rising inflation levels, geopolitical tensions, and global supply chain disruptions remain key challenges that could introduce volatility into the market. Investors should monitor these factors closely to assess their impact on investment decisions.

**Investment Strategies**

In light of the evolving market conditions, it is essential for investors to adopt a diversified and balanced investment strategy. While certain sectors may be outperforming others, spreading investments across various asset classes can help mitigate risks and capitalize on emerging opportunities. Additionally, staying informed about market trends and conducting thorough research before making investment decisions is crucial in navigating the dynamic market environment.

**Looking Ahead**

As the market continues to show strength off the lows, it is important for investors to remain vigilant and adaptable. By keeping a close eye on market developments and adjusting investment strategies accordingly, investors can position themselves to benefit from the evolving landscape. While concerns remain, proactive risk management and a long-term perspective can help investors navigate uncertainties and capitalize on potential opportunities in the market.