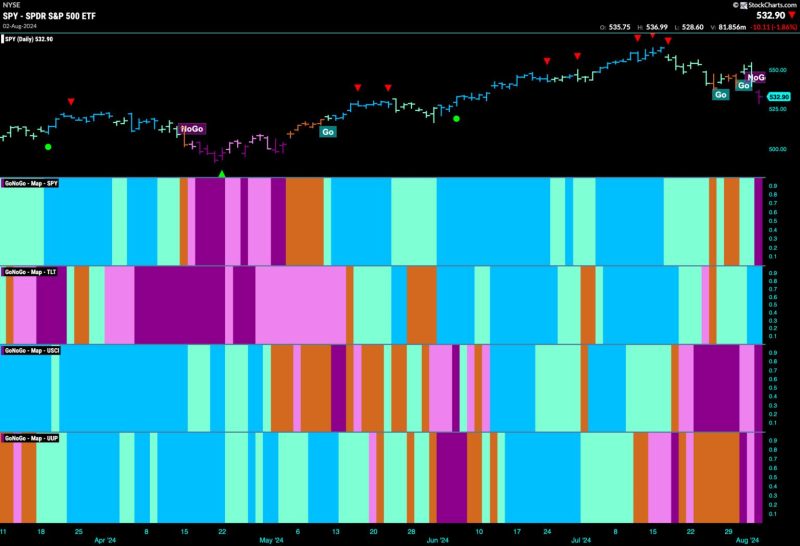

Stocks Get Defensive as Market Index Enters No-Go Territory

In a stark shift of investor sentiment, market participants are turning towards defensive sectors as the broader market index enters what analysts are labeling as No-Go territory. The recent turbulence in the market has prompted a strategic reallocation of capital towards sectors traditionally considered more resilient during periods of uncertainty.

Defensive stocks, characterized by their stable earnings and non-cyclical nature, have seen increased investor interest as concerns over economic headwinds and geopolitical instability continue to weigh on global markets. Companies operating in sectors such as consumer staples, utilities, and healthcare are now in the spotlight as investors seek refuge from the market volatility.

One of the primary drivers of this shift towards defensive stocks has been the growing apprehension over the escalating trade tensions between major economies. The tit-for-tat tariff measures implemented by key trading partners have heightened fears of a potential global economic slowdown, prompting investors to adopt a more cautious stance.

Moreover, the recent inversion of the yield curve, often seen as a harbinger of economic downturns, has further fueled concerns about the health of the global economy. As investors brace for a possible recessionary environment, defensive stocks have emerged as a safe haven due to their ability to weather economic downturns better than their cyclical counterparts.

Amid the prevailing uncertainty, market participants are closely monitoring key economic indicators for signals of potential further market turbulence. Factors such as GDP growth, employment figures, and consumer sentiment are being scrutinized for any clues about the future direction of the market.

In response to these challenging market conditions, investors are rebalancing their portfolios to include a higher allocation of defensive stocks. This strategic shift aims to protect capital against potential downside risks while maintaining exposure to sectors that typically exhibit resilience in uncertain market environments.

Looking ahead, the trajectory of the market will likely be dictated by a confluence of factors, including ongoing trade negotiations, geopolitical developments, and central bank policies. As investors navigate through this turbulent market landscape, a cautious approach that incorporates defensive strategies may prove to be a prudent way to weather the storm and preserve wealth in the face of mounting uncertainties.