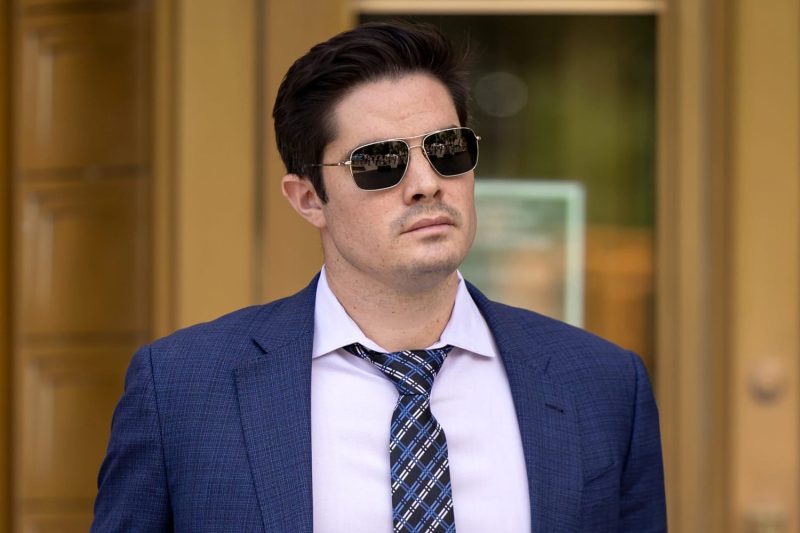

In a recent turn of events that has sent shockwaves through the cryptocurrency world, an FTX executive who once counted Sam Bankman-Fried as a ally, has been sentenced to 7.5 years in prison for his involvement in a high-profile fraud case.

The executive, whose name has been withheld for legal reasons, was a trusted member of the FTX team until allegations surfaced of fraudulent behavior and embezzlement. The case, which has been closely followed by industry insiders and investors alike, highlights the risks and challenges facing the cryptocurrency sector as it seeks to establish itself as a legitimate and transparent industry.

The executive’s fall from grace serves as a cautionary tale for those operating within the cryptocurrency ecosystem, emphasizing the importance of maintaining ethical standards and adhering to the law. As the industry continues to attract the attention of regulators and law enforcement agencies, cases such as this one underscore the need for vigilance and accountability among all industry participants.

The sentencing of the executive also raises questions about the future of FTX and its founder, Sam Bankman-Fried. While the company itself has not been implicated in any wrongdoing, the association with the disgraced executive could have lasting repercussions for its reputation and standing within the cryptocurrency community.

As the case continues to unfold, it is likely to have far-reaching implications for the cryptocurrency industry as a whole. Investors, regulators, and industry participants will be closely monitoring the fallout from this high-profile scandal, in the hopes of learning valuable lessons and strengthening the industry’s overall resilience and credibility.

In conclusion, the sentencing of the FTX executive serves as a stark reminder of the challenges and risks inherent in the cryptocurrency sector. As the industry matures and evolves, maintaining ethical standards and compliance with the law will be paramount in ensuring its long-term success and sustainability.