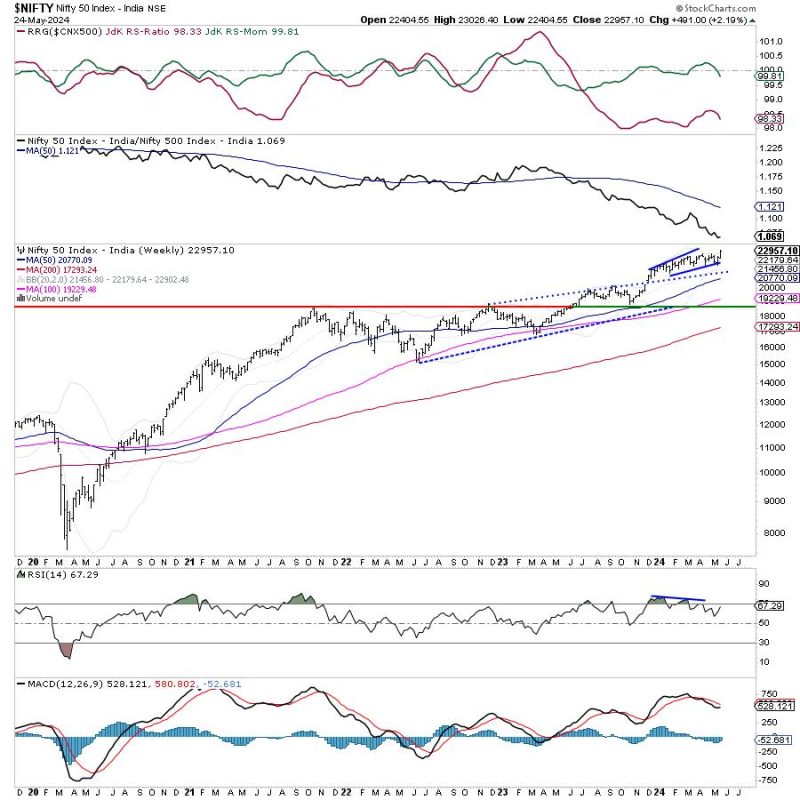

As investors gear up for the trading week ahead, the Nifty index is anticipated to navigate within a volatile range, prompting a cautious approach towards leveraged exposure recommendations. The underlying factors influencing market dynamics mirror a shifting landscape that requires attentiveness and adaptability to ensure prudent investment decisions.

The volatility stemming from global economic uncertainties, geopolitical tensions, and pandemic-related developments continues to cast a shadow on the financial markets. Consequently, it is imperative for investors to recalibrate their risk management strategies in light of these oscillating trends.

While the Nifty index may witness fluctuations, market participants are advised to exercise prudence by curtailing leveraged exposures. This cautious stance is grounded in the need to mitigate potential losses and safeguard invested capital amidst the prevailing uncertainties.

In an environment characterized by rapid market movements, the importance of risk management cannot be overstated. Investors are encouraged to reassess their risk appetite and investment portfolios to align with the prevailing market conditions. By proactively managing risk exposures and avoiding over-leveraging, market participants can shield their investments from undue volatility and unforeseen market shocks.

Additionally, diversification remains a key tenet of sound investment practices. By spreading risk across multiple asset classes and sectors, investors can enhance portfolio resilience and mitigate the impact of adverse market developments. Embracing a diversified investment approach can help navigate the challenges posed by a volatile market environment and position investors for long-term success.

Moreover, monitoring market trends, conducting thorough research, and staying informed about global economic indicators are essential components of informed decision-making. By staying abreast of market developments and leveraging relevant insights, investors can make well-informed investment choices that align with their financial goals and risk tolerance.

As the Nifty index embarks on another trading week marked by volatility, prudence and caution are key watchwords for investors. By exercising discipline in risk management, embracing diversification, and staying informed about market developments, investors can navigate the choppy waters of uncertainty and position themselves for long-term success in the ever-evolving global financial landscape.