In the world of investing and trading, recognizing market trends and signals is crucial for making informed decisions. One such term that often circulates among financial analysts is toppy market. A toppy market refers to a situation where prices may have reached their peak and could be poised for a potential downturn.

Understanding the characteristics and implications of a toppy market can help investors navigate uncertain waters and protect their portfolios from significant losses. Let’s delve deeper into what a toppy market entails and how investors can identify and respond to this market condition.

Characteristics of a Toppy Market:

1. **Extended Bull Run:** One of the telltale signs of a toppy market is an extended period of bullish momentum, where stock prices have continuously risen without significant pullbacks. This prolonged upward trend can lead to inflated asset prices and market exuberance.

2. **Overvaluation:** In a toppy market, valuations of stocks or other assets may become stretched, surpassing their intrinsic value. This may be fueled by investor optimism, speculation, or excessive liquidity in the market.

3. **Decreased Trading Volume:** Another common trait of a toppy market is a decrease in trading volume. As prices reach elevated levels, investors may become cautious, leading to lower market participation and reduced trading activity.

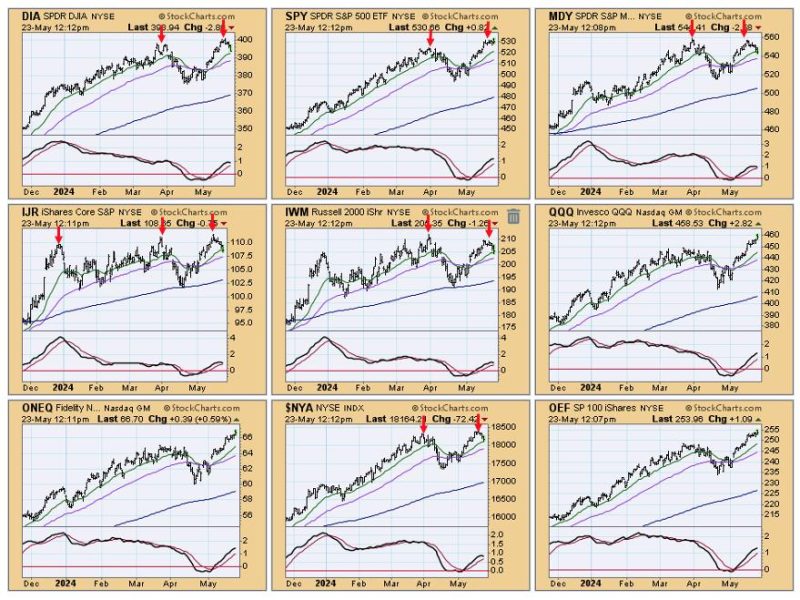

4. **Negative Divergence:** Technical indicators such as the Relative Strength Index (RSI) or Moving Averages can show divergent signals when compared to the rising market prices. This negative divergence suggests weakening momentum and potential price reversals.

Identifying a Toppy Market:

1. **Technical Analysis:** Utilizing technical analysis tools and chart patterns can help investors identify potential signs of a toppy market. Look out for bearish formations like double tops, head and shoulders patterns, or overbought conditions on oscillators.

2. **Fundamental Analysis:** Examining fundamental factors such as earnings growth, economic indicators, and company valuations can offer insights into whether the market is overvalued and susceptible to a correction.

3. **Sentiment Analysis:** Monitoring investor sentiment through surveys, news sentiment, or social media can provide valuable contrarian indicators. Extreme bullish sentiment often coincides with a market top.

Responding to a Toppy Market:

1. **Risk Management:** In a toppy market environment, it is crucial to review and adjust your risk management strategies. Consider diversifying your portfolio, setting stop-loss orders, or reducing exposure to high-risk assets.

2. **Cash Position:** Holding cash reserves during a toppy market can provide flexibility to take advantage of buying opportunities when prices correct. Cash positions offer a buffer against market downturns and allow investors to capitalize on undervalued assets.

3. **Rebalancing:** Regularly rebalancing your portfolio by trimming overvalued positions and reallocating funds to undervalued assets can help maintain a balanced and risk-adjusted investment strategy.

In conclusion, recognizing a toppy market and taking proactive steps to manage risk can help investors navigate volatile market conditions and safeguard their portfolios. By staying informed, utilizing various analysis tools, and implementing prudent investment practices, investors can adapt to changing market dynamics and enhance their long-term financial objectives.