In the world of finance and investment, the importance of rules-based money management cannot be overstated. By implementing specific strategies and methodologies, investors aim to build a structured approach to managing their capital and achieving their financial goals. One crucial aspect of rules-based money management is security ranking measures, which play a significant role in assessing the quality and potential of investment opportunities.

Security ranking measures are essential tools used by investors to evaluate securities based on various criteria. These measures are designed to provide an objective analysis of the risk and return potential of individual securities, helping investors make informed decisions and construct well-balanced portfolios.

One common security ranking measure is the Sharpe ratio, which calculates the risk-adjusted return of a security or portfolio. The Sharpe ratio takes into account both the return generated by the investment and the level of risk taken to achieve that return. A higher Sharpe ratio indicates a better risk-adjusted return, making it a valuable tool for evaluating investment opportunities.

Another significant security ranking measure is the Sortino ratio, which is similar to the Sharpe ratio but focuses on downside risk only. By considering only the downside volatility of a security or portfolio, the Sortino ratio provides a more targeted assessment of risk, particularly for investors who are more concerned about losses than overall volatility.

Furthermore, security ranking measures can include qualitative factors such as financial strength, management quality, industry dynamics, and competitive positioning. These qualitative factors complement quantitative metrics by providing a deeper understanding of the underlying fundamentals and potential risks associated with an investment.

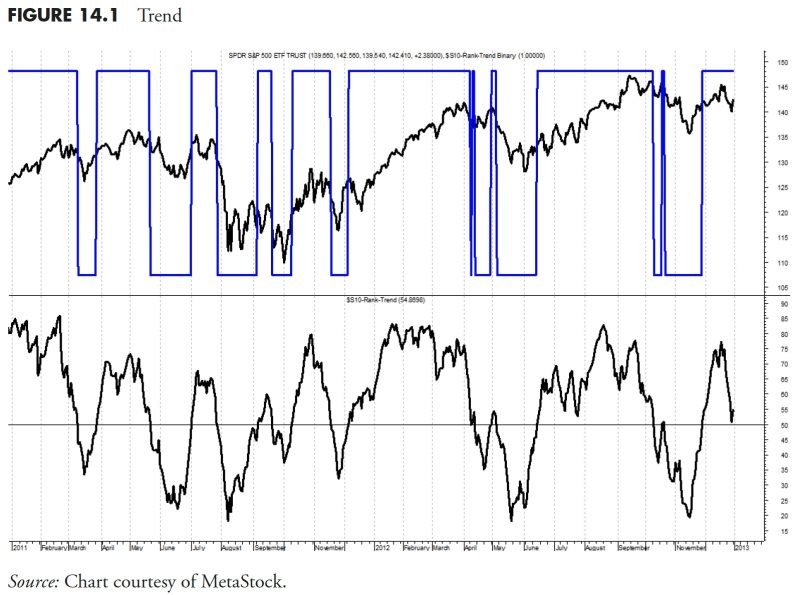

Investors can also use technical analysis tools as security ranking measures to evaluate securities based on historical price patterns, trading volumes, and other market indicators. Technical analysis can help identify potential entry and exit points, trends, and patterns that may influence the future performance of a security.

Additionally, portfolio diversification is a key aspect of rules-based money management that can enhance security ranking measures. By spreading investments across different asset classes, sectors, and geographies, investors can reduce overall portfolio risk and enhance potential returns. Diversification helps mitigate the impact of market downturns and specific security-related risks, ultimately improving the reliability of security ranking measures.

Overall, security ranking measures are vital components of rules-based money management that enable investors to assess the quality and potential of investment opportunities systematically. By utilizing a combination of quantitative and qualitative metrics, investors can make informed decisions, construct well-balanced portfolios, and achieve their financial objectives with confidence.