Silver Cross Buy Signals on the Dow (DIA) and Russell 2000 (IWM)

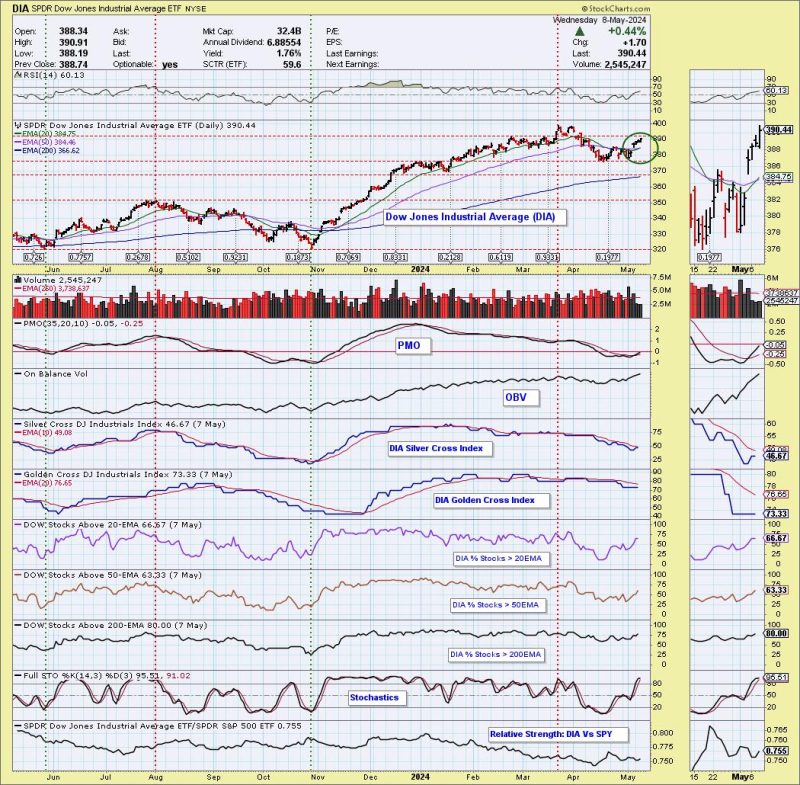

In the world of finance and investment, few things are as sought after as the elusive silver cross buy signal. This signal, which occurs when a short-term moving average crosses above a long-term moving average, is seen as a highly bullish indicator for the market. Recently, both the Dow Jones Industrial Average (DIA) and the Russell 2000 Index (IWM) have been flashing silver cross buy signals, sending waves of excitement through the investment community.

A silver cross buy signal on the Dow (DIA) suggests that the index is poised for a significant uptrend. The Dow is one of the most closely watched stock market indices in the world, representing 30 of the largest and most influential companies in the United States. When the short-term moving average of the Dow crosses above the long-term moving average, it is widely seen as a signal that the index is gaining momentum and is likely to continue its upward trajectory.

Similarly, a silver cross buy signal on the Russell 2000 (IWM) is a positive sign for small-cap stocks. The Russell 2000 Index is made up of 2,000 small-cap stocks, offering investors a glimpse into the performance of smaller companies in the market. When the Russell 2000 flashes a silver cross buy signal, it indicates that small-cap stocks may be on the verge of a strong rally, outperforming larger companies in the market.

Investors and traders alike pay close attention to silver cross buy signals because they have historically been reliable indicators of future price movements. When a silver cross buy signal occurs, it suggests that the overall market sentiment is positive and that buying pressure is likely to push prices higher in the near term.

While silver cross buy signals are certainly exciting for investors, it is important to exercise caution and not rely solely on one indicator to make investment decisions. Market conditions can change quickly, and a silver cross buy signal is just one piece of the puzzle when it comes to analyzing and predicting market trends.

In conclusion, the recent silver cross buy signals on the Dow (DIA) and the Russell 2000 (IWM) underscore the current bullish sentiment in the market. Investors should continue to monitor these indices closely and consider the implications of these signals within the broader market context. As always, it is important to conduct thorough research and analysis before making any investment decisions based on silver cross buy signals or any other technical indicators.