In an ever-evolving landscape of investment opportunities, U.S. stocks remain a cornerstone of many portfolios. While short-term market fluctuations can create uncertainty for some investors, maintaining a long-term perspective can lead to more stable and consistent returns. By focusing on key factors such as market trends, sector performance, and company fundamentals, investors can position themselves for success in the U.S. stock market over the long haul.

Market Trends

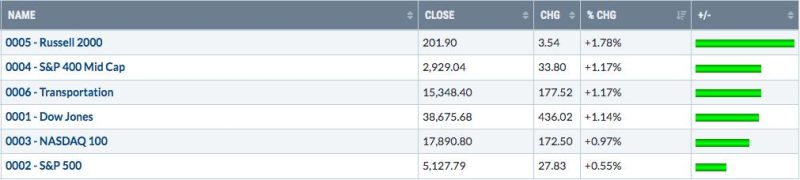

Keeping an eye on broader market trends is crucial for long-term investors. Understanding how economic indicators, geopolitical events, and monetary policies impact the stock market can help investors make informed decisions. While short-term fluctuations may be driven by market sentiment or news events, long-term trends tend to reflect underlying economic fundamentals. By identifying these trends and staying abreast of market developments, investors can better navigate the ups and downs of the stock market.

Sector Performance

Different sectors of the stock market can perform differently based on prevailing economic conditions. For example, defensive sectors like healthcare and consumer staples may outperform during economic downturns, while cyclical sectors like technology and financials tend to excel during periods of growth. By diversifying across sectors and understanding the dynamics of each industry, investors can mitigate risk and capitalize on opportunities across the market. Monitoring sector performance over the long term can help investors identify trends and adjust their strategy accordingly.

Company Fundamentals

At the heart of every stock investment are the fundamentals of the underlying companies. By conducting thorough research on factors such as revenue growth, earnings potential, and competitive positioning, investors can make informed decisions about individual stocks. Long-term investors focus on companies with strong fundamentals, sustainable business models, and a track record of success. By investing in high-quality companies and holding them for the long term, investors can weather short-term market volatility and benefit from the growth potential of solid businesses.

Risk Management

While a long-term perspective is essential for success in the stock market, risk management is equally critical. Diversification, asset allocation, and periodic portfolio rebalancing can help investors reduce risk and protect their investments over time. By spreading investments across different asset classes and rebalancing regularly to maintain desired risk levels, investors can build a resilient portfolio that can withstand market fluctuations. Additionally, setting clear investment goals and staying disciplined in the face of market volatility can help investors stay focused on the long-term horizon.

In conclusion, maintaining a long-term perspective on U.S. stocks requires a combination of market awareness, sector analysis, and company research. By focusing on key factors such as market trends, sector performance, and company fundamentals, investors can position themselves for success over the long term. While short-term market fluctuations may create uncertainty, staying disciplined and sticking to a well-thought-out investment strategy can help investors navigate the stock market with confidence. With a solid understanding of the market landscape and a commitment to prudent risk management, investors can build a robust portfolio that can withstand the test of time.