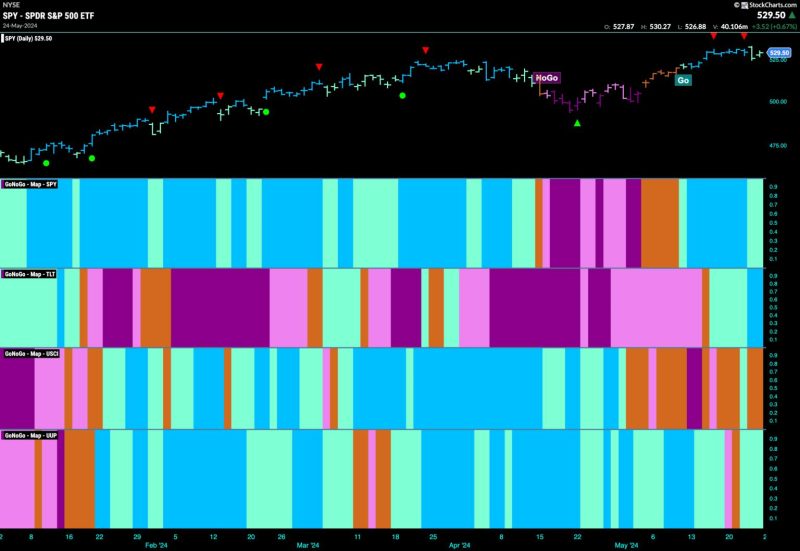

Equities Remain in “Go” Trend with Sparse Leadership from Tech and Utilities

In the current financial landscape, equities seem to be maintaining a positive trend, with sporadic leadership emerging from the technology and utilities sectors. This trend reflects a dynamic and evolving market condition that investors should navigate strategically to capitalize on potential opportunities and mitigate risks effectively.

Tech companies, typically known for their innovation and growth potential, have been playing a key role in driving the equity market forward. Their ability to adapt to changing consumer demands and advancements in technology has positioned them as leaders in the market. Companies like Apple, Amazon, and Microsoft have consistently delivered strong financial performances, attracting investors seeking growth opportunities.

On the other hand, the utilities sector, often considered a safer investment option due to its stable revenue streams and defensive nature, has also shown signs of leadership in the equity market. Utilities companies provide essential services such as electricity, water, and gas, making them less susceptible to economic downturns. Investors looking for steady income and lower volatility have turned to utilities stocks for reliability and consistent returns.

While tech and utilities have shown leadership in the equity market, other sectors have also played a significant role in driving the overall positive trend. Industries such as healthcare, consumer goods, and finance have contributed to the market’s resilience, providing a diversified investment landscape for investors to explore.

Investors should pay attention to the evolving dynamics within the equity market and adjust their investment strategies accordingly. Diversification across sectors and asset classes can help mitigate risks and capture opportunities presented by different market conditions. Additionally, staying informed about macroeconomic trends, geopolitical developments, and industry-specific news can provide valuable insights for making informed investment decisions.

As the equity market continues to show resilience and positive momentum, investors should remain vigilant and proactive in managing their portfolios. By staying informed, diversifying their investments, and adapting to changing market conditions, investors can position themselves for long-term success in the ever-evolving financial landscape.