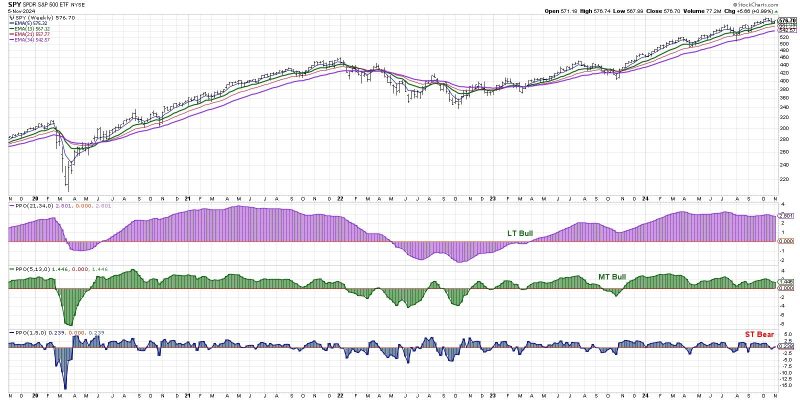

In recent times, investors have been closely monitoring market signals as they prepare for a news-heavy week in the financial world. The anticipation is palpable as traders brace themselves for potential impact on market dynamics. Short-term market sentiment has displayed a bearish signal, prompting investors to exercise caution and make strategic decisions as they navigate through a sea of information.

Market volatility often accompanies periods of heightened news flow, and traders are cognizant of the risks involved in such scenarios. The ability to react swiftly and effectively to breaking news is essential for market participants to capitalize on opportunities and minimize potential losses. As markets brace for a deluge of news, both macroeconomic and corporate developments will play a pivotal role in shaping market sentiment in the days ahead.

One key aspect that investors are closely watching is the outcome of central bank meetings, such as the Federal Reserve’s decisions on interest rates and monetary policy. Any signals from central banks regarding the future direction of monetary policy can have a significant impact on asset prices and market performance. With inflation concerns looming large and the specter of interest rate hikes on the horizon, investors will be closely monitoring central bank announcements for any indications of policy shifts.

Geopolitical events also have the potential to roil markets, and recent developments in various regions have added an element of uncertainty to the investment landscape. From trade tensions to political unrest, geopolitical factors can introduce volatility and unpredictability into markets, making it imperative for investors to stay informed and agile in their decision-making.

On the corporate front, earnings reports are another significant driver of market sentiment. Companies are preparing to release their quarterly results, providing insights into their financial performance and outlook for future growth. Positive earnings surprises can buoy investor confidence, while disappointments may lead to sell-offs and downward pressure on stock prices. Traders will be closely scrutinizing earnings reports and guidance for cues on corporate health and industry trends.

Against this backdrop of heightened news flow and evolving market dynamics, investors must remain vigilant and adaptable in their approach to trading. Utilizing risk management strategies, such as setting stop-loss orders and diversifying portfolios, can help mitigate the impact of adverse market movements. Additionally, staying abreast of the latest news and developments through reputable sources can enable investors to make well-informed decisions in a fast-paced and ever-changing market environment.

In conclusion, as markets brace for a news-heavy week, investors are presented with both challenges and opportunities. By monitoring market signals, staying informed about key events, and adopting a prudent investment strategy, traders can navigate through turbulent times and position themselves for long-term success in the financial markets.