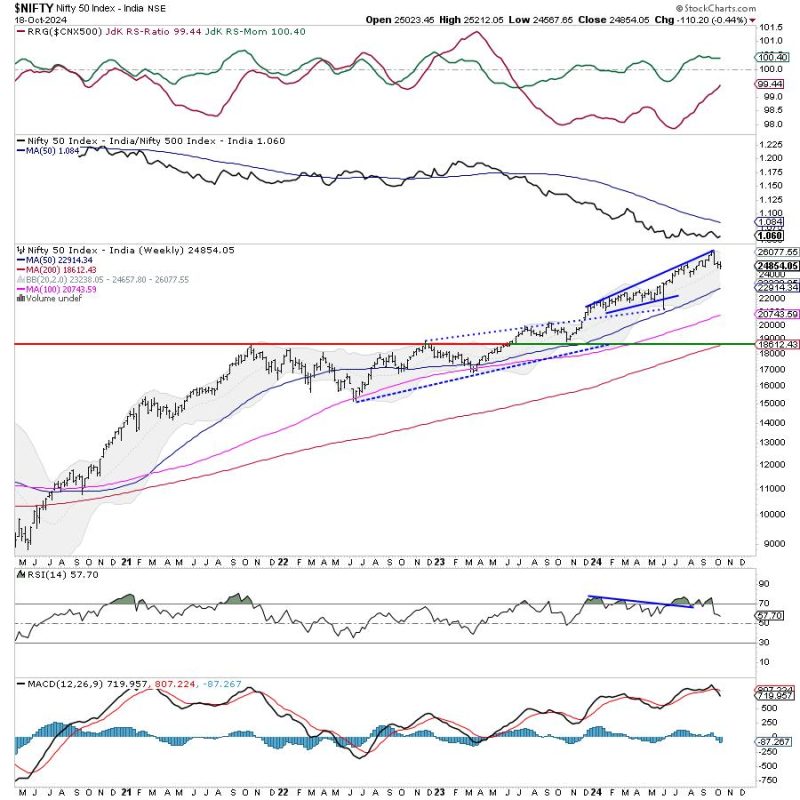

The article discusses the potential market movements for the upcoming week, focusing on the Nifty index. The analysis suggests that the Nifty index may remain within a range, with significant trending moves anticipated only if specific levels are breached.

Market analysts and experts emphasize the importance of identifying key levels in the market’s technical analysis. These levels serve as critical indicators for potential trend reversals or continuations. The article points out that traders should pay close attention to these levels to gauge the market’s directional bias.

Furthermore, technical analysis tools such as moving averages, support and resistance levels, and chart patterns play a vital role in understanding market dynamics. By utilizing these tools effectively, traders can make informed decisions and navigate the market with greater precision.

The article highlights the significance of market psychology in influencing price movements. Traders’ sentiments, market dynamics, and external economic factors collectively contribute to the market’s volatility and direction. Understanding these psychological aspects can provide traders with invaluable insights into market behavior.

Risk management is another crucial aspect emphasized in the article. Traders are advised to define their risk tolerance, set stop-loss levels, and implement appropriate risk-reward ratios in their trading strategies. By managing risk effectively, traders can protect their capital and enhance their long-term profitability.

Overall, the article provides a comprehensive overview of the factors influencing the Nifty index’s potential movements in the upcoming week. By analyzing key levels, leveraging technical tools, understanding market psychology, and implementing robust risk management strategies, traders can navigate the market effectively and capitalize on profitable opportunities.