As the second quarter of 2024 comes to a close, investors are closely scrutinizing the current market conditions, with many expressing concerns about the valuation levels of various securities. The global economic landscape has been marked by significant shifts and uncertainties in recent years, with geopolitical tensions, supply chain disruptions, and central bank policies all exerting influence on market dynamics.

Market participants are grappling with the challenge of assessing whether current asset prices reflect the underlying fundamentals or have veered into overvalued territory. The valuation of equities, in particular, has been a subject of debate among market analysts and investors, with some arguing that stock prices have run ahead of corporate earnings and growth prospects.

Notably, the technology sector has been a focal point of market exuberance, with high-growth tech stocks commanding premium valuations. Companies in the cloud computing, e-commerce, and electric vehicle segments have seen their stock prices soar in recent months, fueled by investor appetite for growth and innovation. However, skeptics caution that these valuations may not be sustainable in the face of rising interest rates and potential regulatory headwinds.

Amidst the debate over valuation levels, some market observers have pointed to signs of frothiness in certain areas of the market. Speculative activities, such as meme stock trading and the proliferation of non-fungible tokens (NFTs), have added to the perception of market excesses and heightened risk-taking behavior. Investors are being urged to exercise caution and conduct thorough due diligence before making investment decisions in this environment.

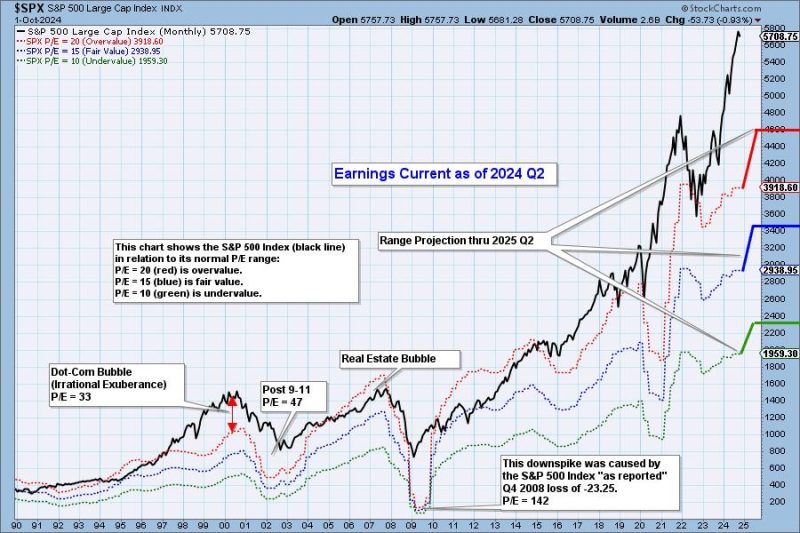

Meanwhile, traditional valuation metrics, such as price-to-earnings ratios and price-to-sales ratios, are being closely scrutinized for signs of overheating. In some cases, these metrics have reached levels not seen since the dot-com bubble of the early 2000s, leading to concerns that a correction or revaluation may be on the horizon.

On the other hand, proponents of the current market environment argue that low interest rates, ample liquidity, and strong corporate earnings growth provide a solid foundation for continued equity market gains. They believe that broader economic trends, such as the ongoing digital transformation and green energy transition, support the valuations of companies at the forefront of these secular shifts.

In conclusion, the question of whether the market is very overvalued in the second quarter of 2024 remains a matter of ongoing debate and analysis. Investors are advised to remain vigilant, assess risks prudently, and stay attuned to changing market dynamics as they navigate the complexities of today’s investment landscape.