In the dynamic landscape of the stock market, it is crucial for investors to stay updated with the latest trends and developments in order to make informed decisions. The week ahead in the Nifty market promises to be an intriguing one as a defensive setup starts to take shape. Understanding key levels and patterns can help investors navigate the market with confidence and strategize effectively.

As we look towards the upcoming week, it is important to note the tentative nature of the Nifty as it grapples with various internal and external factors that can influence its movement. The development of a defensive setup suggests that market participants are taking a cautious approach, potentially seeking refuge in safe-haven assets amid uncertainties.

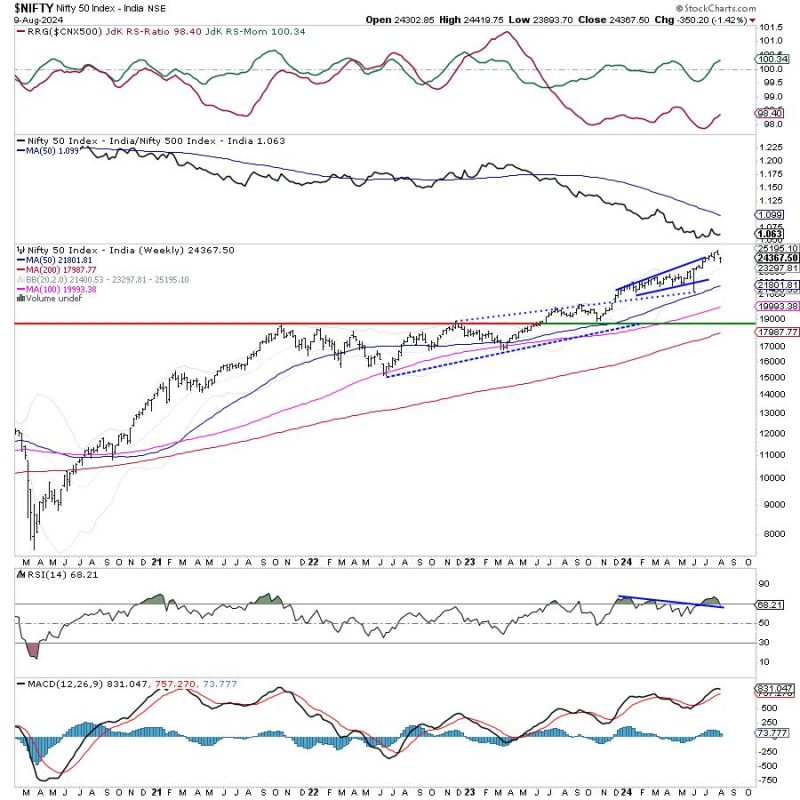

In this environment, being aware of crucial levels becomes paramount for traders and investors. These levels act as potential areas of support and resistance, providing valuable insights into market sentiment and potential price movements. By knowing these levels well, market participants can plan their trades more effectively and manage risks accordingly.

Technical analysis can be a valuable tool in deciphering the market’s movements and identifying key levels. Chart patterns, trendlines, and other technical indicators can help traders gain a deeper understanding of market dynamics and anticipate potential price movements. By honing their technical analysis skills, investors can make more informed decisions and improve their overall trading performance.

Apart from technical analysis, keeping abreast of fundamental factors that can impact the market is also essential. Economic indicators, geopolitical events, and corporate earnings reports are just some of the factors that can influence market direction. By staying informed about these developments, investors can adjust their strategies accordingly and capitalize on emerging opportunities.

In conclusion, the week ahead in the Nifty market promises to be an intriguing one as a defensive setup develops. By understanding key levels, leveraging technical analysis, and staying informed about fundamental factors, investors can navigate the market with confidence and make well-informed decisions. Being proactive, flexible, and disciplined are key attributes that can help investors succeed in today’s dynamic market environment.